The set it and forget it method

Cost: free

Plenty of F.I.R.E (Financial Independence Retire Early) advocates will say, “just put your savings/investment money in an ETF (Exchange Traded Fund) like the SPY. Over time it will go up and your money will increase.” Technically this is correct because historically over time the SPY has gone up. However, there are periods of time when the SPY also goes down. It is not just a linear line of upward movement. This is also true of the stock market as a whole. Some will advise to “buy the dip” (buy when the price is down). The problem with that is how do you know it’s a dip? You don’t. You could buy shares at $389 a share and the stock could go lower or higher. In fact, the current 52 week range for the SPY is ~$348 to ~$489. You could think, ok, I’ll wait for it to get closer to $348 before buying but the problem is it may never do that or it may go even lower. The stock market is cyclical, but which direction it is going to go on any given day or year isn’t something that anyone can predict.

So, what would be a slightly better strategy for someone who wants to invest but doesn’t necessarily want to learn all about the stock market and trading?

The monitor and adjust method

Cost: free

The better step is to at least learn how to recognize if your chosen ETF is in an uptrend or a downtrend and then move your money out of the ETF during periods of time when it is in a downtrend. A trend isn’t a one day event but rather a cycle of movement over weeks and months. How can I tell if my ETF is in an uptrend?

The easiest method is to look at a stock chart with the 50 day simple moving average included. Is the line moving upward or downward? That is the direction of your trend. The more thorough method is to look at these key indicators:

On Up days you want to see higher volume

On Down days you want to see lower volume

Relative Strength Line is in an uptrend

The 50 day simple moving average is in an uptrend and the current price is above the line

If there are Gaps, they are to the upside (you don’t want to see gaps down)

You would either move your money to cash if the overall market is down trending or you would move your money to a better performing ETF if it’s just your ETF that is doing poorly (relative to other ETFs). This has the advantage of not costing any money to do (you can look up the charts on finviz or yahoo.finance for free) but does require that you monitor the market for changes in momentum for your desired ETFs.

The have someone (or something) else monitor it for you for a modest fee

Cost: $10 per strategy/month

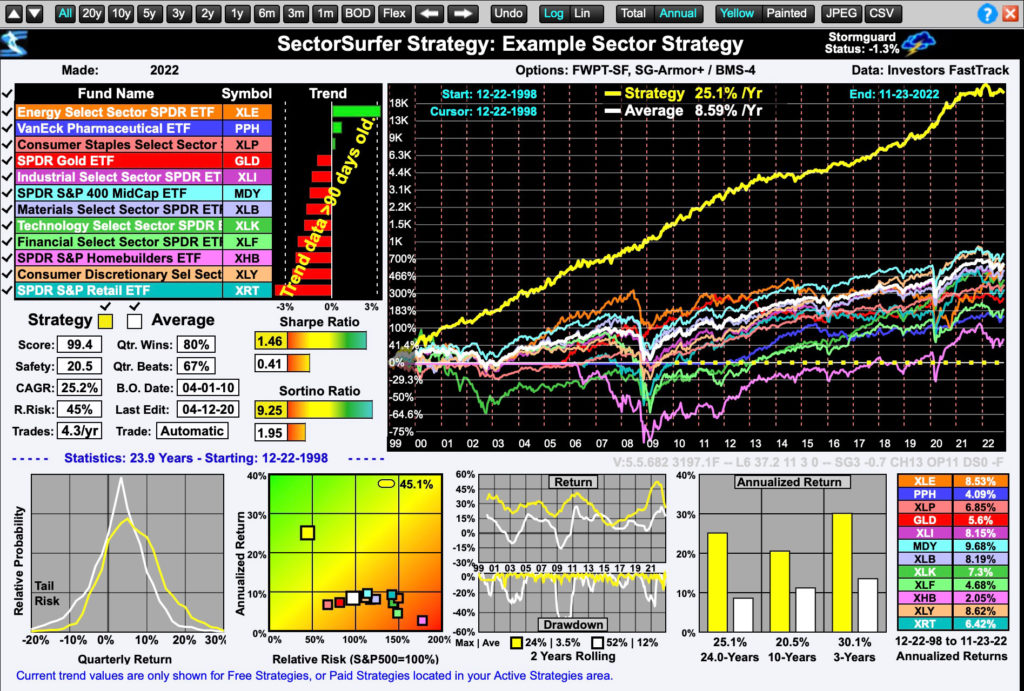

The best step for someone who wants to invest but doesn’t have the motivation/time/desire to learn to trade the market is to subscribe to a service such as SectorSurfer (I have no affiliation with the company, I just believe in what they do for the common people -not charge too much and make it easy for laypeople to invest while achieving better returns). The way their service works is you set up a “Strategy” with different ETFs or you can set up a Strategy with the tickers from your retirement fund (or both). The key is to choose diverse ETFs to place in your strategy (you don’t want them to be too similar or it doesn’t work as well) and then connect your brokerage account. Their software will monitor the ETFs in your strategy and will send you an email with which ETF is currently performing the best out of the ones in your strategy. It will give you either a Hold, Buy (a better performing ETF) or Cash signal. So, if your ETF is still performing the best in your strategy you would get a Hold signal, if another ETF is doing better it will tell you which ETF in your strategy to move your money too, if the market overall is in a bear market or a major sell off the software will advise you to move your money to cash. In this way, you preserve your capital through downtrends and use it to your advantage in uptrends.

Here I have offered three solutions for those of you who want to invest but don’t particularly want to devote the time and energy to learn how to interpret the market. I believe the first method’s proponents don’t have a good understanding of the stock market but if the current market is a bull market when applying that method, many will be satisfied with their returns. The second two methods (one free and one with a modest fee) can provide you with better returns over time. I would recommend either of those two methods over the buy and hold or “just keep buying” method of F.I.R.E advocates. I hope you enjoyed this simple and quick investing with ETFs explanation.

*Disclaimer: There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Go Rise Up Investing or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

Read Understanding Exchange Traded Funds to learn more about ETFs.

Read Determining if and when to follow your trade advisor software’s recommendation

2 thoughts on “Simple Stock Market Investing with ETFs”