What is an ETF?

An ETF (Exchange Traded Fund) is made up of various stocks that you then can purchase one share of rather than owning individual shares of multiple stocks. Think of it as buying a bundle rather than buying one item in a bundle. For example, rather than buying one share of Tesla stock for $200, you could buy multiple shares of an ETF that contains some Tesla stock along with other companies stock.

Advantages of buying ETFs?

One advantage is that you can own portions of many different companies where if you had to buy a share of each stock individually you might not be able to afford them all or at the least, it would cost a lot more. It is similar to being able to buy fractional shares (buying a portion of a share of stock rather than one whole share) but with many companies bundled in one share.

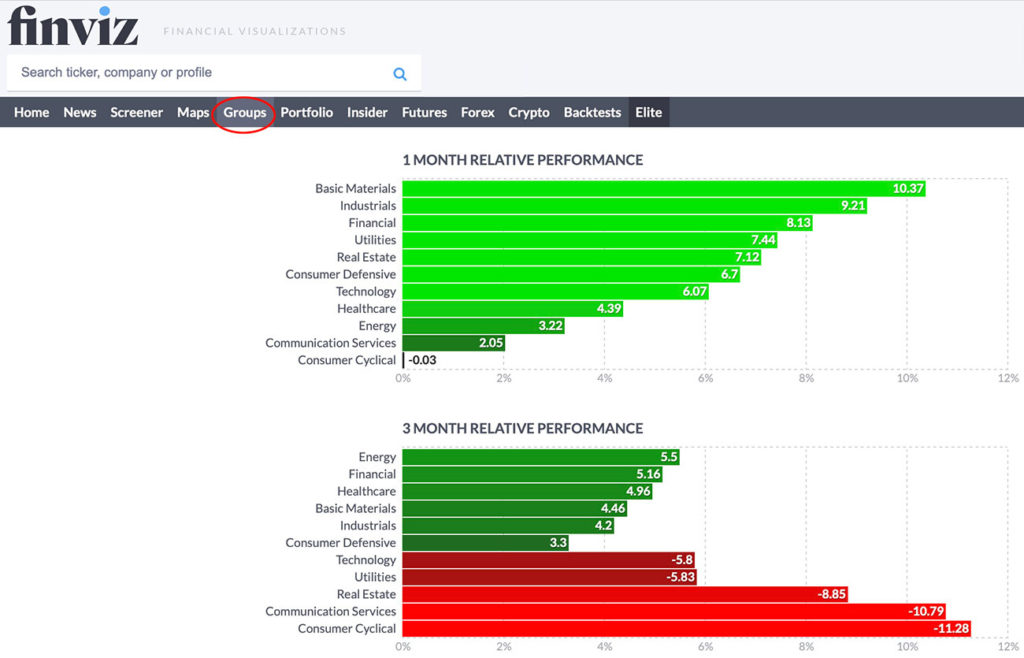

Another advantage is that you can research sectors/industry groups and buy an ETF in a top performing sector or industry. You can do this research easily on Finviz.

Here is a list of the 11 Stock Market sectors and their associated ETF ticker symbols.

Materials: XLB

Industrials: XLI

Financials: XLF

Info Tech: XLK

Consumer Discretionary: XLY

Consumer Staples: XLP

Energy: XLE

Healthcare: XLV

Communication: XLC

Utilities: XLU

Real Estate: XLRE

In addition, there are many other ETF funds that you can invest in based on your interests.

Some popular ones are the $SPY and $QQQ. The 10-year return for SPY is +243% and the 1-year return is -13%. The 10-year return for $QQQ is +386% but the 1-year return is -27%.

Thirty-seven percent of a stock’s price movement in directly tied to the performance of the industry group the stock is in. Another 12% is due to strength in the overall sector. This means roughly half a stock’s move is driven by the strength of it’s group. ETFs allow you to invest in the group.

There are also inverse ETFs that allow you to invest in an ETF when it is doing well and it’s inverse ETF when it is doing poorly. An example would be SQQQ and TQQQ which are inverse ETFs of the QQQ. This has the advantage of allowing you to take advantage of a downtrend without the dangers of shorting a stock.

Disadvantages of buying ETFs?

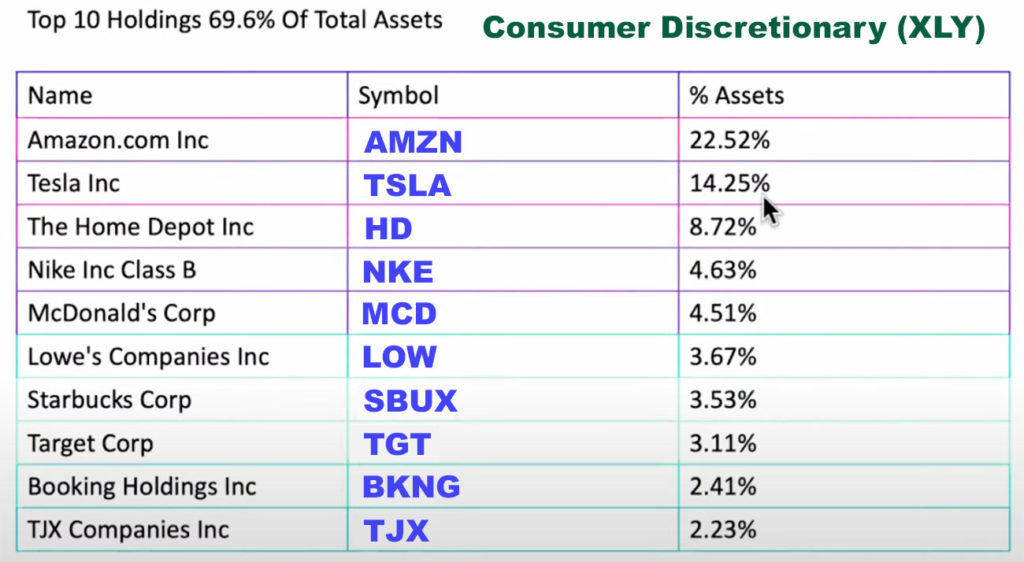

Sometimes the lower performing companies in an ETF can lower it’s value. And I don’t mean the smaller companies with lower performance in an ETF. The number of shares of individual companies is not equally distributed and in fact, certain companies have a greater effect on the overall whole. If Amazon stock is performing poorly then it has a greater impact on the overall performance of the XLY ETF because it makes up 22.52% of the fund.

ETFs are funds managed by a company and so if they buy too much or a poor performing stock or if they invest in types of stocks that are not currently doing well, the fund suffers. A good example of this is Cathie Wood’s ARK fund ETF. Imagine buying shares at $55 and being down to $15 a share.

Hopefully this gives you a better understanding about ETFs. Interested in learning more about investing in ETFs? Read: Simple Stock Market Investing with ETFs

One thought on “ETF explained -Understanding Exchange Traded Funds”